I usually keep system ideas and designs to myself. I let my readers in on the mechanics of system trading such as money management, position sizing, etc. But, the actual generation and creation of a system has always been personal. And to be honest...never wanted to give away an edge.

I guess, times are a changing. I've decided to develop and test a system idea in real-time here on the blog. My point isn't to build a system for you, the reader. The point is to share my process...how I capture an idea logically. And more importantly how to continually develop and test until a) the idea's acceptance into the trading library or b) the idea's admittance into Heavenly Hills System Cemetery.

So, what's the idea?

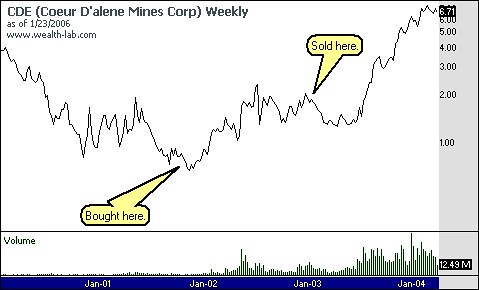

Ever sell a stock out of boredom? When you bought the stock...it looked great. But, after months of underperformance...no better yet...after months of the stock doing nada...you sell. The good news is you didn't really lose money on the investment. But, didn't make any either.

A few weeks or months after closing out your position...the stock breaks to a higher level. Not by a whole lot...still higher than you've ever seen while holding the melba toast. Since the price isn't that much higher than your selling price...you ignore it.

Weeks...months...maybe years go by. Then, like the curiosities of an old flame, the mind wonders...what ever happened to that stock I held back in the day? Pulling up the quote in Yahoo Finance hits you like a Mac truck. That melba toast gained more than 10 times the price you sold it for. Oh, if only I had held it. If only I could stand a little fiber in my diet.

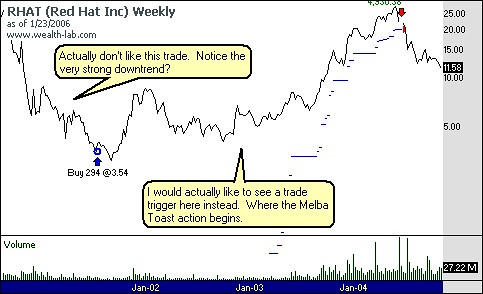

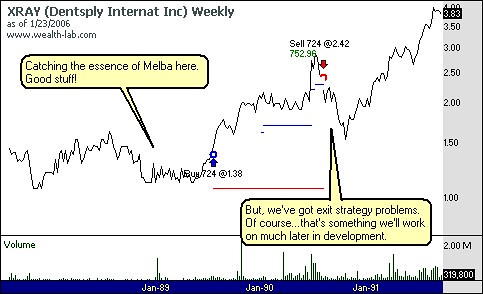

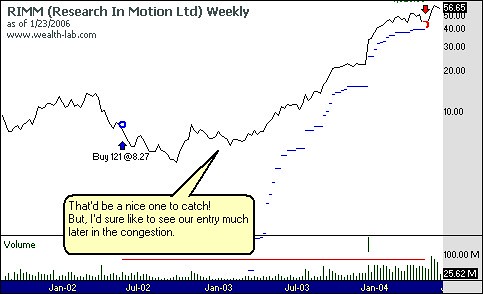

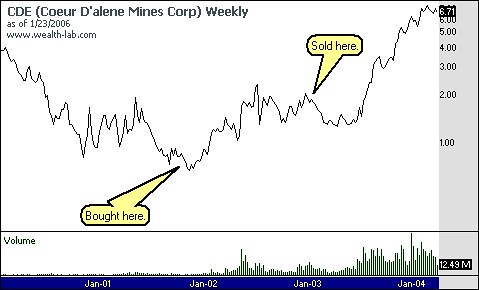

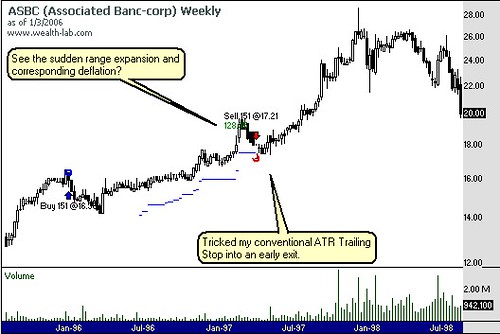

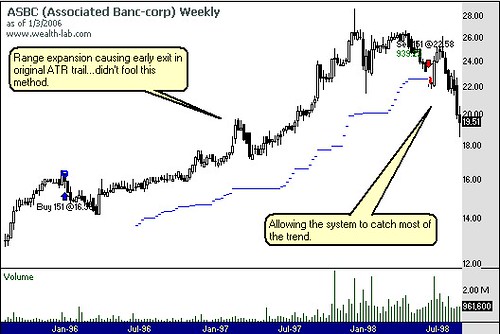

How many of these stocks have you encountered in your trading life? I've experienced plenty. Here are some examples.

About 90% of my equity is allocated to my systems. Around 10% is left as fun money. I can buy stocks for any reason and hold for as long or short as I like with this fun money. The examples above are trades made with this fun money. As you can tell...the trades were horrible. But, this fun money does two very important things for me.

- Allows me to release the self-destructive side of my trading where I can participate a bit with the market masses without destroying my bottom-line.

- By participating in the euphoric buying and panic selling sprees I feel all the things the masses feel. I know what it's like to put 100% of my fun money into one position and get hit like The Equities Research Center's FCL trade. To experience those feelings enable me to observe the patterns and more importantly generate system trading ideas.

And with that we get to the main point. How do we logically capture the stocks that go from nothing to something? The Melba Toasts of the world?

My initial thoughts are to identify areas in the time series where buyers are not rewarded. Basically, no new highs are made within a certain time period...let's say one year or 50 weeks.

What about the downside? I think it's okay for the market to make new lows...but not too much on the downside. So, maybe we can check the max closing low for the past year and compare against the average. How many ATR's is the lowest closing price from the 50 week average? Less than 1 ATR sounds about right.

What else? Hmmm...trend. Yes, we need to check the trend of the stock. We basically need a stock that is not trending upwards. So, trending downwards to a degree...or better yet...no trend at all will provide the maximum frustration for holders of the stock while still keeping them in it.

Let's also add a minimum volume filter of at least a 50 week average daily volume greater than 20,000 shares.

So, what do we have?

- No new highs within the past 50 weeks;

- (50 week average close - 50 week lowest closing price) less than 50 week Average True Range (ATR);

- No uptrend in place;

- At least 20,000 shares traded daily for the past 50 weeks.

- We'll slap a 2 * ATR disaster stop and a 3 * ATR trailing stop from the closing price.

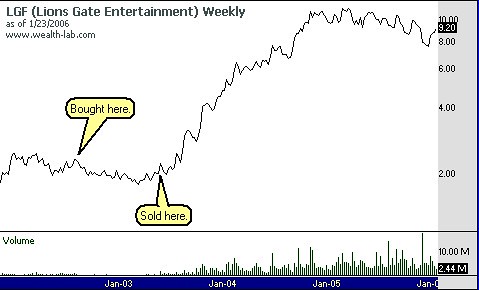

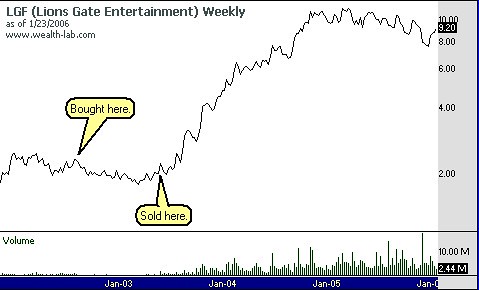

Results? Here's what we've captured on the LGF chart with these rules in place:

Looks good, huh? Well, believe it or not...we've got one heck of a long way to go. LGF is just one stock. Now, the real work begins. And I'll have to leave that for another night. Until then...

Later Trades,

MT