The critical ingredient is a maverick mind. Focus on trading vehicles, strategies and time horizons that suit your personality. In a nutshell, it all comes down to: Do your own thing (independence); and do the right thing (discipline). -- Gil Blake

Monday, November 28, 2005

Quote of the Week

How many of you get stuck in your trading? Can't seem to make progress? Well, sometimes the fish just aren't there to catch. You can work as hard as you want and still catch nada. The key is to cast that net until you find fish.

What happens when no more fish are caught? You must move on...because the fish already have.

Later Trades,

MT

Tuesday, November 22, 2005

Taylor Turkey System

Under the system, you purchase the index on Wednesday (day before Thanksgiving) and sell the Monday after Thanksgiving. How will it perform this year? Ah, should be interesting. Will I invest my hard-earned money? No, probably not. While it's a fun little system showcasing the holiday effect...just too few data points for me. But, with a quick and dirty test on the current Nasdaq 100 stocks...you earn a profit factor of 3.15. Of course, that's not counting commissions and slippage. Still, not too shabby for turkey lurkey day.

Well, gotta get...some more system work to do. Just what kind of stuff am I working on? Hmmm...let's see...it involves a bit of Bill Cara's Value Line Research, Victor Neiderhoffer's Triumph of the Optimist, Michael Covel's Trend Following post, and Ben Bernanke's MO.

I hope all is great with you and yours. Everyone have a wonderful Thanksgiving.

P.S. TraderMike needs to start working on those New Year's Resolutions for 2006! Time is a tickin! Ha ha!

Later Trades,

MT

Monday, November 21, 2005

Quote of the Week - Decision

Analysis of over twenty-five thousand men and women who have experienced failure disclosed the fact that lack of decision was near the head of the list of the thirty-one major causes of failure.I believe these quotes are from Think and Grow Rich by Napoleon Hill. But, found them in the MasterMind Forums here.

Procrastination, the opposite of decision, is a common enemy which practically every man must conquer.

Analysis of several hundred people who had accumulated fortunes well beyond the million-dollar mark disclosed the fact that every one of them had the habit of reaching decisions promptly, and of changing these decisions slowly, if and when they were changed. People who fail to accumulate money, without exception, have the habit of reaching decisions very slowly, if at all, and of changing these decisions quickly and often.

These quotes are the type that should be read more than once. Allowed to soak in your brain. Stew over. Or as they say where I'm from, "Chew on for awhile."

And one last one from Hill for dessert:

"You must get involved to have an impact. No one is impressed with the won-lost record of the referee."

Later Trades,

MT

Monday, November 14, 2005

Quote of the Week

"Try a thing you haven't done three times.

Once, to get over the fear of doing it.

Twice, to learn how to do it.

And the third time, to figure out whether you like it or not."

-- Robert Evans (creator of Godfather)

Great words of wisdom. Especially for ADD'ers like myself. Easy to get frustrated with something and cross it off your list forever without ever taking the time to find out whether you truly like it or not.

The quote was from Robert Evans. Ever heard of him? I hadn't before I found this quote a few years back. Evans has lived quite an interesting life. Read this interview for some particulars, and don't miss out on how Evans discovers "The Smile"....aka Jack Nicholson.

Friday, November 11, 2005

New Blog Find

Check out his post on The Reminiscences of an Infant Investor. I quite like his behavioral bent to investing/trading.

Favorite lesson from his post? "Lesson 2: You are not as smart as you think you are."

Ain't it the truth.

The site also has several great quotes sprinkled throughout. Such as this one from Pascal: "Heart has its reasons, that reasons don't understand." Nice!

MT

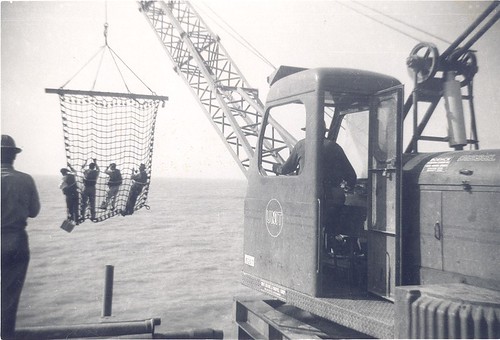

Serenity Now

Well, this might not give the old oil rig workers much serenity now...more like the bad memories, nightly sweats from before. :)

Seriously, this is what you had to climb in on if you wanted to do offshore work in the gulf.

My dad is the 2nd on the right. Picture taken in 1954.

MT

Nassim Taleb Interview

Psychologists ran experiments to see how people absorb information. In one experiment they found people who work with racehorses, and asked them to name up to 50 pieces of information they would need [to determine if it was going to be a winner]. They ranked them by order of importance. They took the 10 most important ones out of 50 and looked at the prediction of accuracy to determine if a horse will win a race. Then they took the 20 most important pieces, then the 30. In the end, you had no gain in predictive power beyond the first 10 pieces of information, but a huge gain of overconfidence...

It's the market that creates the indicator, not the indicator that creates the market.

To become Bill Gates you need more luck than skill. But to become a prosperous person, you need more skill than luck.

I believe Warren Buffett has skills, but probably two-thirds of it comes from an environment that helped him.

I am unable to predict markets, but I know it.

The favorite quote being the Bill Gates more luck than skill. I've referenced that type of thinking back in this post on Relativity by Dr. Mike Ott here. I strongly believe that environment makes up at least 2/3 of a person's success. The other 1/3? Ah, that's your edge.

Got Edge?

MT

Random Markets?

MT

Thursday, November 10, 2005

Taleb's Notebook

Not much happening on the homefront. Busily evaluating a trading idea....while the list of new ones rapidly pile on my desk. Speaking of desk notes...I have to really thank one of the commentors on this blog for recommending EverNote. I was very reluctant at first especially since it involved organizing my thoughts from the scattered scraps of paper and journals to a forum that's neat, tidy, and structured. But, I've really grown to like this little product. I'm slowly but surely beginning to keep everything stored in EverNote and the pile of notes are becoming electronic in form. Kinda cool. At least my wife thinks so. :)

This weekend? Somehow got wrangled into installing ceramic tile in my dad's kitchen. Hows' that for a howdy-do? But, it should be fun and filled with adventure. I'm just afraid the rest of the family will see the results and want more of the same. They'll just have to wait because dad has bigger plans for this computer geek...hardwood flooring!

One last thing...check out the movie Dreamer with Kurt Russell, Dakota Fanning, and Kris Kristofferson. I was really surprised...my wife and I saw it on our date night and I thought it had chick flick written all over it. That might be...still a good heart-warming movie that showcases the struggle of safety and stability against risk and opportunity.

Enjoy your weekend!

MT

Monday, November 07, 2005

Quote of the Week - Einstein

Boy, Albert, I sure hope you're right. Cause I've been trying to figure out this market for a heck of a long time!

Question is...how long should you stay with the problem versus cutting your losses and moving on to something else? How many other Einstein's have stayed with the problem til' their dying day...never solving the problem?

To test this theory out...

Try picking stocks and setting a profit target of 50% and don't sell until they hit it. Only two possible outcomes to this test: Stock will hit the profit target Or it won't. Time is removed from the equation except for the length of your lifespan. If the profit target is hit...you'll have found an Einstein.

Same Test as above but exit the stock if 50% target is not reached within a year. Same possible outcomes as the prior test but Time is added to the equation.

Are you better for your Sticktoitiveness or for Cutting Losses Short?

P.S. Would be interesting to see how many stocks bought the day of their IPO acheive their profit target and go on to become Einstein's? Would we consider 50% gain worthy of Einstein status? 100%? 300%?

Later Trades,

MT

Friday, November 04, 2005

Quote of the Week

"The Heights by Great Men Reached and Kept were not Attained by Sudden Flight, but They, while their Companions Slept, were Toiling Upward in the Night." -- Henry Wadsworth Longfellow

Maybe I'll try to post a Quote of the Week every Monday.

Have a good weekend everybody! My plans? Well, I plan to put my daughter to work. She received a rocking chair from her Papa on her birthday. And she would like it finished the color purple. So, her and I will sand and prime the chair this weekend. Should be fun.

MT

Wednesday, November 02, 2005

System Analyzer and Y2K

Also, check out Jon Tait's discussion on Profit Factor and his sneak peak of his backtesting project.

System Analyzer - FathersDay Edge

|

Funny, how it has taken many hours/weeks and brain-fried late nights in order to input, process, output into the simple little HTML table above. Reminds me of a story about the Y2K problem.

I was working around the clock for hours, weeks, and months on end in order to get our administrative systems ready for Y2K. For those few who don't remember...the Y2K issue centered around the fact that legacy systems used the 2 digit years instead of the 4 digits. And year calculations and comparisons drive a multitude of systems. So, if you compare the year 05 against 99...you get issues. Capisci?

Anyways, while I was burning the midnight oil getting everything in order...either converting everything to 4 digit years or windowing the problem...I got a call from a friend of mine.

Friend: "Hey, have you heard about this Y2K crap? Everybody is just making this Y2K stuff up, I tell ya. You watch...when January 1, 2000 gets here...nothing will happen."

Me: "You're right, nothing will happen because programmers like me have been working our butts off trying to make sure nothing will happen."

Friend: "Huh?"

Me: "Listen, it works like the George Soros Reflexivity theory. If all the programmers know there's a Y2K problem then the Y2K problem grows less of a problem as more of the problem is understood and worked on by those programmers. So, you are correct, when January 1, 2000 gets here...nothing will happen."

Friend: "Huh? Are you telling me Y2K is or isn't a problem."

Me: "Ah, Forget it. I gotta get back to work."

Friend: "Whatcha working on?"

Me: "The Y2K problem...[hangup]"

Six months later my friend calls me up on January 1, 2000 after I had stayed up all night to ensure our batch systems ran correctly and was still in the process of verifying their results.

Friend: "Hey, Happy New Year! I don't mean to rub it in...but I knew it, I knew it, I knew it! That Y2K was just a bunch of mumbo jumbo! Like I told you before...here it is Jan 1, 2000 and nothing...NADA...happened!"

Me: "Happy New Year yourself. And yes, there was a Y2K problem and we fixed it so nothing happened like I told you before!"

Friend: "Huh? Now, Mike, how can it be a problem if nothing happened!"

Me: "Ah, forget it...go watch your football games...I gotta get back to work"

Friend: "Work? Work? On New Year's Day? What the heck? What they got you working on now?"

Me: "Y2K...[hangup]"

Later Trades,

MT

Thursday, October 27, 2005

Serenity Now

Picture taken with my head out the car while driving through the beautiful Georgia Mountains.

MT

Wednesday, October 26, 2005

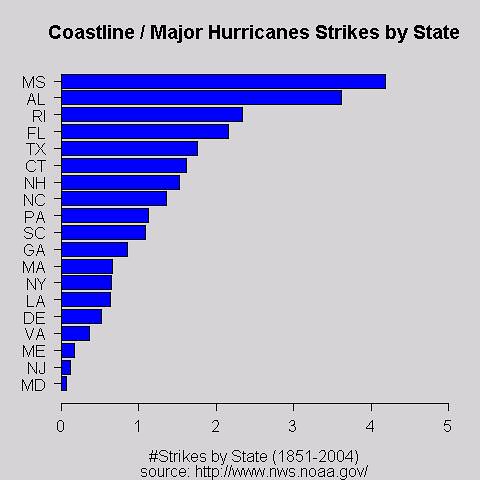

Coastline by Major Hurricane Strikes by State

Thought the graph above would better reflect which states receive the most hurricanes per coastline miles. As you can see this is quite different than the original graph showcasing states and their respective hurricanes hit. The prior graph showed Florida, Texas, and Louisiana being the top three. Those are now replaced by Mississippi, Alabama, and Rhode Island. Rhode Island? Say what? Okay, this chart is definitely more interesting than the last one.

Heck, according to this information...Louisiana is in the bottom 6. Also, interesting that Louisiana has more coastline than Texas.

MT

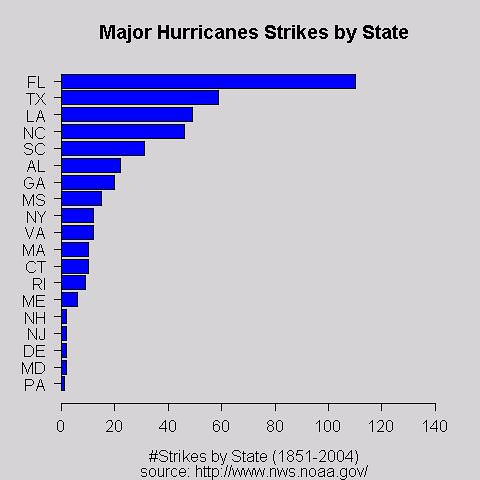

Hurricanes by State

Working with the R project's barplot function and decided to play around with some hurricane data. The chart above reflects the number of hurricanes (major) making landfall by state. Nothing too surprising in the numbers.

The mean of the #of hurricanes by state is 22 while the median is 12. Which makes sense due to Florida being hit 5 times more than average. And Texas and Louisiana being hit more than 2 times the average.

MT

Monday, October 24, 2005

Rumor of reduced commissions at Interactive Brokers...

Not sure if this is true or not...but if so...might need to re-evaluate my broker choices. Hmm....

Later Trades,

MT

Sunday, October 23, 2005

Moneyball the Market

The two sides are, on the one hand, the old scouts and, on the other, Billy Beane. The old scouts are like a Greek chorus, it is their job to underscore the eternal themes of baseball. The eternal themes are precisely what Billy Beane wants to exploit for profit - by ignoring them." -- Michael Lewis

"By analyzing baseball statistics you could see through a lot of baseball nonsense. For instance, when baseball managers talked about scoring runs, they tended to focus on team batting average, but if you ran the analysis you could see that the number of runs a team scored bore little relation to that team's batting average. It correlated much more exactly with a team's on-base and slugging percentages. A lot of the offensive tactics that made baseball managers famous - the bunt, the steal, the hit and run - could be proven to have been, in most situations, either pointless or self-defeating." -- Michael Lewis

"tinkering with the records of baseball games to see how the machinery of the baseball offense works. I do not start with the numbers any more than a mechanic starts with a monky wrench. I start with the game, with the things that I see there and the things that people say there. And I ask: Is it true? Can you validate it? Can you measure it? How does it fit with the rest of the machinery? And for those answers I go to the record books...What is remarkable to me is that I have so little company. Baseball keeps copious records, and people talk about them and argue about them and think about them a great deal. Why doesn't anybody use them? Why doesn't anybody say, in the face of this contention or that one, "Prove it"?" -- Bill James

These are some of my favorite quotes from the book, Moneyball by Michael Lewis. I especially like the Bill James quote basically asking why if we have the data and are asking the right questions...why oh why don't we use them in our strategies? Instead we focus on arguing our point with opinions. Enjoy reading books where the author makes the case to invest in stocks because Echo Boomers are an emerging powerful consumer and a host of other dynamics that can't be tested nor quantified on enough data points to matter.

This is why I like the recent Larry Connors book, How Markets Really Work. No opinions or pithy remarks. Connors instead focuses on Moneyballing the Market. Taking commonly held beliefs and turning them upside down and exposing them for what they truly are...eternal themes of the market sung by the Greek chorus of brokers, analysts, and media pundits.

Questions are asked and data is analyzed. And this analysis of data is what triggered this review. It changed the way I create, test, and design my systems. Before I would come up with an idea and immediately run a template system with my idea to expose the common statistics I look for...win%, avg gain, max drawdown, etc. From there I would begin filtering to improve and refine.

But, I really like the Connors method instead. He asks a question like is it true that new short-term highs are a sign of a healthy market? Then collects data on short-term highs and corresponding returns and short-term lows and corresponding returns into table form. Then he creates bar charts and equity curves of the comparison between the two to aid in visually analyzing the results of the study. I can see all kinds of possibilities with this method. It feels like more of your original edge is maintained instead of getting bogged down into filtering down the edge into the statistics you are trying to achieve. Plus, via the bar charts and equity curves you can really see whether the edge you think you have is true and robust against a benchmark and opposite view. One of the possibilities of this method is throwing in acrary's random trades from the Edge Test into the mix.

The downside of the book? I would enjoy more tests! More questions! It's just rare to find someone who asks and tests the questions you've been asking and answering yourself. Only other book like it that I've found is Altucher's Trade like a Hedge Fund book. I would have also enjoyed some discussion on how the questions asked relate to individual stocks within the general market.

Overall a book that can help in your pursuit of trading Jeet Kun Do. With that in mind, I'll leave you with this quote:

"True observation begins when one is devoid of set patterns." -- Bruce Lee

Side Note

What's happening to my Astros? It's the 8th inning and Astros are down by 2. The Sox pitchers seem to have the Astros ticket. Especially last night when we had just a good lineup at bat and the big wide one took em' down...one by one. Ah! The pain of being a Houston Astros fan. :)

C'mon Stros!

Later Trades,

MT

Sunday, October 16, 2005

I'm Back!

The difficult part was being cut-off from the Internet for such as long time (1 week). Ha ha. And I'm paying for it with all the emails and blogs to read. The blogosphere has been busy!

I also got a chance to dive into the book, How Markets Really Work by Connors and Sen. A great book and one that triggered several system ideas that I'm anxious to work on. I plan to discuss more on this book later in the week...so stay tuned!

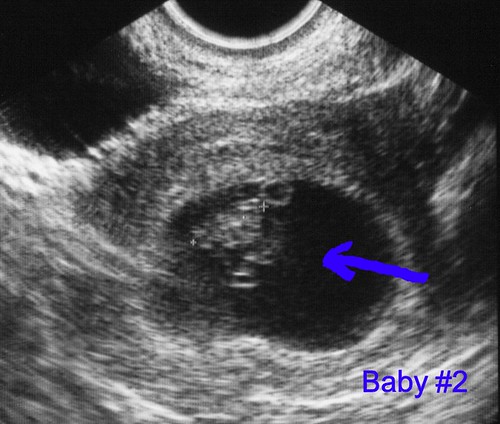

Also, thank you to everyone on the baby news congrats. I really appreciate it.

Well, gotta get back to my rat-killin...so check out these posts that caught my attention and I'll write more later.

Recent interview of Ryan Jones a.k.a Fixed Ratio Jones by TradingMarkets. Read here.By the way, a big thank you goes out to April for introducing me to Ginger Ale on our recent trip. Great stuff. Can you believe I've never had ginger ale before? I know, I know...I'm showing how backwoods I am. April was kind enough to send me home with two bottles. Also, they grilled some steak that was amazing and were kind enough to share their seasoning secrets...Dale's Seasoning. Amazing stuff. And another thank you to Mysti for taking us to the Fair and letting us borrow their MapQuest to get home. I really don't know how we would have gotten back without it. Thanks guys!

This article by Steven Gabriel shares some of the insights from the book, How Markets Really Work. Read here.

Nice blog by Dr. Wish that I recently stumbled across. Here's one of his posts detailing the Darvis Method of Trading. Read here. There's some great system ideas in this post to test.

Later Trades,

MT

Friday, October 07, 2005

Having a Baby!

Just got back from the doc...it's official...we're having another baby!!!

Enjoy your weekend!

MT

Monday, October 03, 2005

Interview with Hank Camp from TradingMarkets

Trading using the PREM. I've actually coded a crude version of PREM in my systems before...but never knew the true technical term until this article.By the way, do you keep a trading notebook for articles like these? To jot down notes, ideas, further research topics? I've got stacks of these things. I've briefly addressed this topic before on dealing with ADD and the need to write things down...but I think this would benefit all traders out there. For example, tonight I have my notes from the above interview along with action items to test in my nightly system studies.

Nice tidbits on quote services and nomenclature of the PREM series (DTN, Esignal, Comstock, and TradeStation). Check out their website for further detail on quote providers here.

Interesting insights into event trading such as "reverse manipulation" during options expiration, days of the week (option expiration Mondays, unemployment report Fridays, and Friday 13th), and William %R.

Actually, first thing I'm starting off with tonight is testing a volatility stop involving the close divided by a long-term moving average. Call this value R. Then smooth R with a shorter moving average duration. Apply a lower band of 3% to 5% from the smoothed R and if the original R drops below the smoothed R...scale out a portion of the whole position or get out entirely. This vol stop was discussed in the recent AIQ Opening Bell newsletter. You can find several issues of the Opening Bell here. Enjoy!

Later Trades,

MT